By Dr. Sam L. Savage

Isaac Newton’s System of the World (1728)[i] included a now-famous sketch showing how firing a cannon from a mountaintop at increasing speeds would ultimately place the projectile into orbit. It took the world 229 years—until Sputnik 1 in 1957—to turn that idea into the Space Age.

Similarly, my father, Leonard Jimmie Savage, helped set the stage for the Chance Age with his Foundations of Statistics[ii] (1954) containing his axioms of subjective decision-making under uncertainty, following von Neumann and Morgenstern’s expected-utility foundation[iii] (1944) and preceding Ron Howard’s unification of these ideas in 1966 into Decision Analysis (DA)[iv].

The premise was simple, but application was difficult. It assumes that:

1. People will correctly assess uncertainties,

and

2. Will make rational decisions to maximize expected gain in the face of them.

In the 1950s, this was impractical. Just as Newton believed it was important to understand physics, my father believed it was important to understand the basis for rational decision making. But just as Newton did not encourage people to start building rockets in the early 18th century, my father did not view his work as immediately applicable and wrote that such fully rational planning was “utterly beyond our power… even to plan a picnic.”

Yet progress came quickly. Nobel Laureate, Harry Markowitz—indoctrinated, in his own words, “at point-blank range” by my father at the University of Chicago—applied these ideas to create Modern Portfolio Theory. Ron Howard’s DA was widely applied at top strategic levels within corporations and the military. Then came Option Theory, Financial Engineering, and the trillion-dollar derivatives market. But until recently, the twin hurdles of assessing uncertainty and knowing what to do about it, kept the approach from being applied to everyday decisions.

Technology to the Rescue

It took centuries to turn Newton’s thought experiment into satellites. It took only decades for DA to become mainstream, now embedded in:

Autonomous vehicles, balancing travel time against accident risk.

Medical decisions, weighing cures against side effects.

Cybersecurity strategies, trading convenience against breach probability.

And yes— even a phone app called Next Picnic that helps plan picnics, including uncertain weather.

The Chance Age: Storing Uncertainty as Stochastic Data

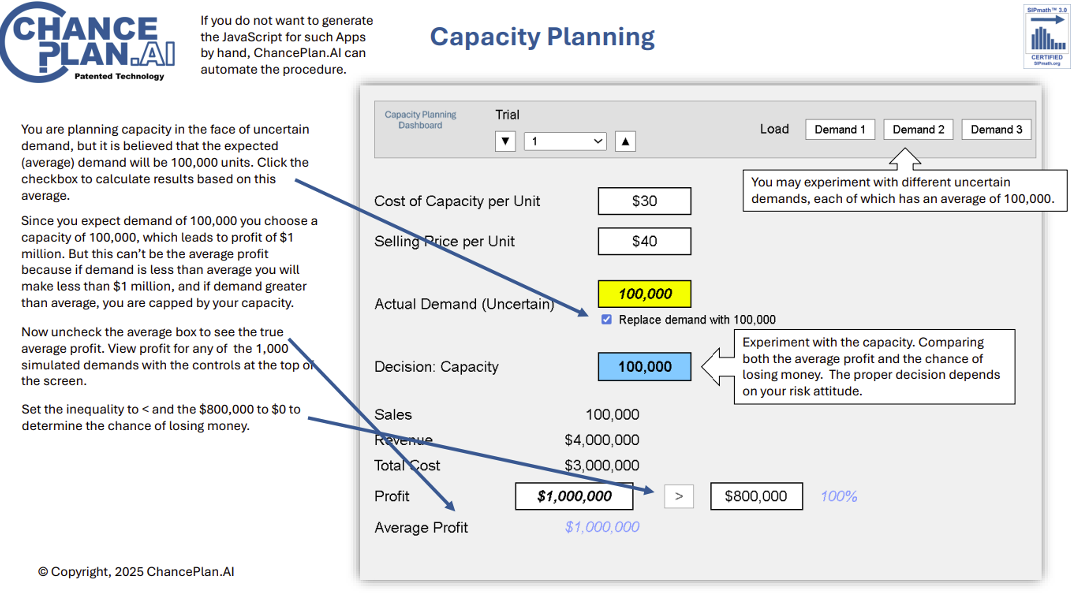

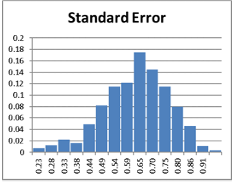

Just as Hindu-Arabic Numerals allow for efficient communication and calculation of numeric quantities, Stochastic Data allow for efficient communication and calculation of uncertainties. It lowers the barriers to DA in two ways:

1. Assessing Uncertainty

Prediction Markets

A modern extension of my father’s view of probability as personal wagers, producing probabilistic forecasts easily expressed as Stochastic Data.Big Data in the Cloud

Vast data streams—unimaginable in 1954—now provide the raw material for coherent uncertainty quantification.Artificial Intelligence

A refinery that transforms raw data into assessed uncertainty at unprecedented scale.

2. Decision Engines

Ubiquitous computing puts powerful DA machinery everywhere.

Monte Carlo Simulation

Turns uncertainty into computation and now both reads and writes Stochastic Data, enabling Stochastic Networks for enterprise decisions.Stochastic Optimization

The birthplace of Stochastic Data in financial engineering, finding optimal risk–return trade-offs.Machine Learning

Decision trees, random forests, neural nets, and other techniques act as automated decision engines, especially when wired into Stochastic Networks with Stochastic Data.

The Latest Handbook of Decision Analysis

My longtime friend Greg Parnell and I recently reconnected just as he was preparing the 2nd Edition of his Handbook of Decision Analysis[v]. The first edition made use of Windows based Monte Carlo software, which students needed to buy. I helped him replace this with our open-source ChanceCalc, which runs on Mac and PC and produces models that do not require the add-in to run.

John Wiley & Sons, publisher of both my father’s book and my own Flaw of Averages[vi], has now released the new edition and I was honored that Greg asked me to write the Foreword. In the process, I found that Greg was so aligned with the mission of ProbabilityManagement.org that I invited him to join the Board of Directors.

After decades in the field, we are both astonished to find ourselves surfing the biggest wave of technological change in our careers.

As one of Greg’s students, a working professional, told him:

“Our company tells us that we won’t be replaced by AI, but we could be replaced by someone who uses AI better than we do.”

John Wiley & Sons has generously offered a discount on Greg’s new book (through 4/30/2026). Visit wiley.com to purchase using discount code HDA20.

[i] Newton, Isaac (1728), A Treatise of the System of the World, F. Fayram, London.

[ii] Savage, L. J. (1954). The foundations of statistics. John Wiley & Sons.

[iii] von Neumann, J., & Morgenstern, O. (1944). Theory of Games and Economic Behavior. Princeton University Press.

[iv] Howard, R. A. (1966). Decision Analysis: Applied Decision Theory. Proceedings of the Fourth International Conference on Operational Research.

[v] GS Parnell, TA Bresnick, ER Johnson, SN Tani, E Specking, Handbook of Decision Analysis 2nd Ed. (2025), John Wiley & Sons.

[vi] Savage, S.L. The Flaw of Averages: Why We Underestimate Risk in the Face of Uncertainty. John Wiley & Sons, 2009, 2012.

Copyright © 2025 Sam L. Savage